The 5G controversy came to a head in early 2019. Many Allies became concerned about the security of future intra-Alliance commercial and military communications, primarily – but not only – because of risks posed by non-Allied suppliers. After months of discussion and debate, NATO leaders meeting in London in December 2019 stressed the importance of “the security of communications, including 5G” and recognised “the need to rely on secure and resilient systems”.

What is 5G?

5G is the ‘fifth generation’ in mobile communications. In the 1980s, 1G enabled voice calls; messaging arrived with 2G in the 1990s; 3G brought limited multimedia, text and internet data in the 1990s and early 2000s; and, in the late 2000s, true data with access to dynamic information using various devices were made possible by 4G and LTE (‘Long-term Evolution’, a standard for improving wireless broadband speeds to meet increasing demand).

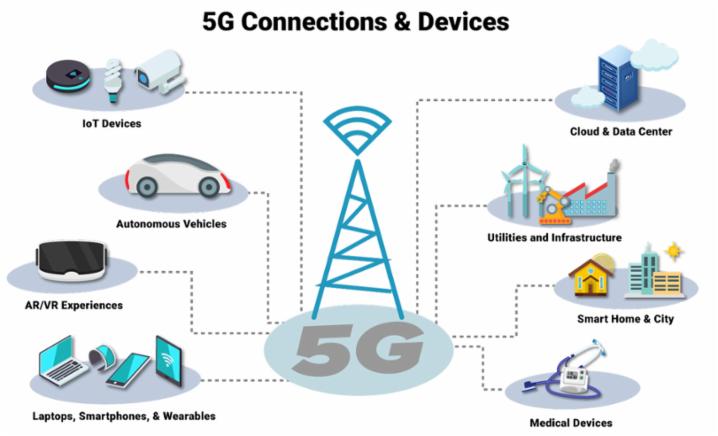

With the arrival of 5G networks, mobile communications will morph into a radically different model centered on high density, large volume, extremely high speed (20x), low latency or delay in data transfer (10x) and power efficiency. From handset-to-handset communications such as phone-to-phone, 5G will enable the transition to machine-to-machine communications. This will support not only voice and digital conversations but also the massive real-time sharing of data, which characterises the Internet of Things, telemedicine, the running of smart cities, as well as the performance of autonomous cars.

Why did 5G take centre stage in 2019?

While 5G communications became a hotly debated public and political issue in early 2019, the road to 5G started years earlier thanks to progress in technology as well as multilateral standardisation agreements.

Technological progress includes changes in the design of the entire network, which allow for enhanced spectral efficiency through numerous signal paths (MIMO: Multiple Input, Multiple Output). Progress in electromagnetic engineering enables the efficient transmission of data highly resilient to reflection and interference (beamforming and OFDM: orthogonal frequency-division multiplexing). Advances in software help deliver a better quality of communications by using algorithms on both the original and the received data stream (polar coding).

Agreements on standards and technical issues reached in various forums – including at the Mobile World Congress organised by the Global System for Mobile Communications Association and at the International Telecommunication Union – enabled the entire industrial ecosystem to move forward collectively.

As a result, by the end of October 2019, 50 mobile operators had launched commercial 5G services in 27 countries. Moreover, between 2018 and 2019, several European countries including Finland, Italy and Spain held 5G multi-band spectrum auctions – the key step for the roll-out of 5G networks.

Why it matters?

Four main reasons related to telecommunications underlie the increased attention to 5G.

First, telecommunications are broadly speaking an enabling technology, which can drive economic growth across the entire economy. Forecasting models predict for example that 5G networks will add trillions of dollars of economic value to the international economy. Just as 4G unleashed a major wave of technological transformation – from the iPhone and Google.maps to Instagram and Whatsapp via Uber and Snapchat – 5G networks are expected to deliver similar effects.

Second, telecommunications are generally dominated by a first-mover advantage: early entrants can accrue enormous economic value, leaving little room for competitors. Actors – from companies to countries – thus have a strong incentive to consolidate their position and maximize economic returns.

Third, telecommunications carry a strategic dimension: the speed, quality and quantity of information are crucial for competing in the digital world.

Finally, given the centrality information plays in modern economies, telecommunications are widely, and rightly, considered a strategic industry. Companies transfer private, and often sensitive information. Governments share diverse types of data, including classified material.

Next generation telecommunications will affect every aspect of society, from transportation to healthcare, as well as our military operations.

5G and China

Another important reason that 5G has attracted particular attention is that the leading players in this technology are not Western, Japanese or South Korean companies but rather China-based companies like Huawei and ZTE.

Several factors explain the rise of Chinese operators in this domain. One is the expertise and experience they acquired with their failed bid to enter the 3G competition over a decade ago. Following this, the Chinese government launched major public investments in this area and developed a coherent strategy, while private companies conducted research and patented their seminal technologies. Chinese companies also enjoy a competitive advantage, especially when approaching foreign markets on 5G: at home, they can count on a widespread availability of fibre, large deployments of small cells, a higher availability of spectrum in low-frequency bands and the maturity of 4G, as well as an enormous domestic market and low production costs.

Chinese, Japanese and South Korean companies have long played an important role in telecommunications markets around the world. In fact, Huawei and ZTE from China as well as Nec (Japan) or Samsung (South Korea) are key suppliers in current 4G networks. However, the role of Chinese companies in 5G communications has a very different connotation.

With 5G – involving massive machine-to-machine communications – perimeter cyber defence will no longer be effective as it will be impossible to grant access exclusively to authorised devices. As a result, the risk and potential severity of attacks grow exponentially. Also, the more important role of software in network virtualisation will grant equipment integrators (i.e. potentially Chinese companies) wider and deeper access into network operations (i.e. data), thus raising serious questions about trust and reliability.

In other words, changes in technology have severe political implications, especially because Chinese companies have direct political connections to their government, including to the intelligence community. China’s internal big data policy – based on massive surveillance and limited privacy – is at odds with other countries’ systems of values, ethics and law.

And finally, Chinese companies have in recent years repeatedly been accused of stealing intellectual property and using cyber-espionage to access proprietary information. Tests on Chinese electronic devices have often also revealed security vulnerabilities, including backdoors that can lead to the direct transfer of data to China.

NATO Allies and 5G

Until last December, NATO had taken no stand on 5G communications. Even after the London Leaders Meeting, no single policy or position has truly emerged. Looking at the Allies’ response, we can identify five main groups: the concerned, the lawmakers, the undecided, the sceptics and the early adopters.

The concerned

To date, the United States is the only NATO country that has taken effective steps to restrict access to its 5G network from Chinese companies like Huawei or ZTE. Importantly, however, the US administration’s ban announced in May 2019 has not yet entered into force due to 90-day extensions that have been renewed four times.

Congress has passed some bills with wide bipartisan consensus – such as the so-called “rip and replace act” (signed into law by President Trump in March 2020) – which compel Huawei and other Chinese companies to stick to stricter security controls or, in other cases, support Western companies in the 5G competition.

Along the same lines, in May 2020, the U.S. Department of Commerce announced an amendment to its Entity List, subjecting Huawei to individual licensing requirements for exports. By targeting Huawei’s acquisition of semiconductors, the decision aims to curtail severely the company’s competitiveness. Huawei eventually confirmed that such an amendment would put its very survival at stake. Similarly, the U.S. Department of State launched the “5G Clean networks”, a plan for setting a “clean path” for allies of the United States to exclude Chinese vendors from their networks.

The lawmakers

Some Allies, such as Italy, have not placed a ban on Chinese 5G equipment manufacturers but have already committed to stricter regulations. In late 2019, the Italian government approved a law establishing a “National Cyber-Security Perimeter” which in turn introduced more stringent rules and procedures to assess the security of 5G equipment.

Germany fits into the same category. Despite a passionate internal debate, the Federal Government is not expected to ban Chinese companies from its 5G network. Deutsche Telekom has already announced that it will continue working with Chinese 5G providers.

The undecided

The positions of some NATO countries have evolved over time, progressively adopting a stricter stance.

The Czech Republic signed a joint declaration with the United States on 5G security on 6 May 2020, stating the intent “to strengthen our cooperation on 5G” and determine whether the network is “subject, without independent judicial review, to undue foreign influence”.

Similarly, after an initial assessment phase in January 2020, the Greek government slowed the deployment of 5G infrastructure owing to “national security and protection of the country’s critical infrastructure”.

The United Kingdom is another example. Initially, in January 2020, the British government announced a 35 per cent cap on Huawei’s participation in the “non-core part” of the 5G network, while barring it altogether from the “core part”. Later, in May 2020, Downing Street adopted a different position, proposing a “5G Club” of 10 democracies (the G7 countries along with Australia, India and South Korea) to create alternative suppliers of 5G equipment and other technologies to avoid relying on China.

The sceptics

The vast majority of Allies have not barred or limited the role of Chinese companies in their 5G infrastructure.

In France, for instance, Orange and Vodafone already chose Ericsson (Sweden) and Nokia (Finland) for their 5G networks. Nonetheless, both the government and the intelligence community have signaled that they do not see any valid reason to exclude other foreign providers. Similarly, the Belgian government announced it would impose constraints only on “unreliable suppliers”. Other Allies, such as Canada, have so far taken no decision on Chinese companies.

The early adopters

Finally, another group of countries have already adopted Chinese 5G technology and – given the high replacement costs of the infrastructure – are unlikely to backtrack. Within NATO, these are Hungary and Spain.

However, several early adopters, although not NATO countries, are important for the Alliance or some of its Allies. In Europe, these include Ireland, an EU member, and Serbia, a potential future EU member, and Switzerland. Among Gulf States, other examples are Bahrain, Kuwait, Oman, Saudi Arabia and the United Arab Emirates, which to different degrees host military bases or personnel of different NATO Allies. In Asia, Indonesia and the Philippines are among the countries to have adopted Huawei’s 5G technology.

Where next?

The discussion on 5G will continue in the months and years ahead, and the issue is likely to acquire further salience as military communications start to transition to 5G.

In the future, for NATO in particular, it will be of central importance to exploit these new technological opportunities for command and control, communications, as well as for other purposes. Without 5G communications, it will be difficult to fully exploit big data, artificial intelligence and cloud computing on the battlefield.

The transition of military communications to 5Gwill enable the exploitation of big data, artificial intelligence and cloud computing on the battlefield. © Federal News Network

It is important that all Allies be fluent with the discussion and understand the implications of this transition: at the economic, political and military levels. This is necessary to ensure the provision of training as well as the development of new concepts of operations and appropriate changes to procurement and force structure.

At the same time, the debate should be informed by sound technical, economic and strategic considerations (including cohesion within the Alliance). For this reason, modular architectures – in which open interfaces enable equipment from different vendors to be integrated together – could become a viable option in the years ahead to reconcile different requirements and considerations. Without a single dominant player, this solution could allow the Allies to achieve security without compromising their economic efficiency, to have access to an effective and resilient communications network free from supply disruptions.